Telephone 020 3813 2890 for a free no obligation chat about your regulatory requirements with one of our compliance consultants.

© Compound Growth Limited 2012 - 2020 | Terms of Use Privacy Policy

Registered in England and Wales as limited company number 07626537 - Registered Office 120 Pall Mall, London, SW1Y 5EA

We use cookies, if you consent to this use, please continue to browse our site.

Here to help with Regulation and Compliance

March 2015

HMRC confirms UK financial institutions are no longer required to file nil returns

Ahead of the Foreign Account Tax Compliance Act (FATCA) return deadline of 31 May, two recent updates have changed the reporting criteria:

Foreign Account Tax Compliance Act: UK Reporting

HM Revenue and Customs (HMRC) have provided an update that could have significant implications for those in the UK that were previously expecting to report under the US Foreign Account and Tax Compliance Act (FATCA).

This development could see a significant reduction in the number of financial institutions, trusts, certain specified insurance companies and other entities that were expecting to have to file reports under FATCA.

Reduced reporting categories of Financial Institutions:

HMRC have expressed that the UK tax authorities will not require nil reporting for the Intergovernmental Agreement with the US. This means that the number of financial institutions that were expecting to have to file a report will be greatly reduced.

In addition, HMRC have also expressed that treasury companies and relevant holding companies should not be treated as financial institutions, as initially considered.

Both of these factors could have considerable knock-on effects for particular groups.

FATCA Nil Reporting Not Required:

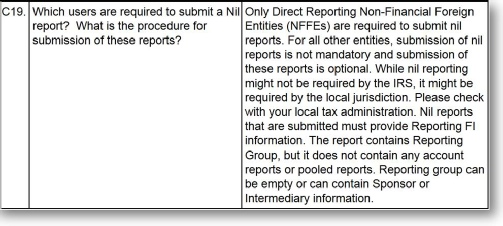

Nil reporting by firms is also addressed in the Frequently Asked Questions (C19) of the Internal Revenue Service (IRS). The guidance provided by the IRS confirms that it does not require nil returns to be made, other than those by Non-Financial Foreign Entities, but did recognise that Intergovernmental Agreement countries, (such as the UK), may require nil reporting to be submitted locally.

However with HMRC’s latest position now clarified it seems nil reporting will not be required locally for the Intergovernmental Agreement with the US.

So, why have HMRC taken this stance? Well, it seems that because the amended Directive of Administrative Cooperation and proposed OECD Common Reporting Standard plus the agreements with the Crown Dependencies and Overseas Territories do not require submission of nil returns, the UK tax authorities have also taken the view that nil reporting will not be required.

What are the implications?

Whilst the clarification that treasury companies and relevant holding companies should not be treated as Financial Institutions is welcome, this will mean that these entities will need to ensure they are able to update any self-certifications that they have supplied to others as soon as the legislation has been amended and within a 30 day time period of this happening.

Furthermore, many firms that have already registered for FATCA reporting with HMRC may no longer need to report. The UK tax authorities are expected to issue additional information next month on how these firms may deregister from FATCA reporting, however, until then, HMRC has confirmed that firms may choose whether to submit a nil report in the meantime, or wait until the legislation is amended when a nil return is no longer required.

What is unclear at this time is whether firms will be able to continue to make a nil report once the legislation is changed should they so choose, as the IRS have made it known they consider these returns best practice, even if not required by local law and have publicly declared they intend to use non-filing for three consecutive years as an indicator of possible noncompliance.

HMRC Update on FATCA Nil Reporting:

As issued by an HMRC Spokesperson this month (March 2015):

Useful FATCA links:

- HMRC FATCA Reporting Page

- FCA FATCA: Meeting your obligations

- IRS FAQs: FATCA International Data Exchange Resources and Support Information (IDES)

“The US have recently clarified in their IRS FATCA FAQ pages that they are not expecting countries with whom they have entered into an Inter-governmental Agreement (IGA) to require their local FIs to file nil returns. In view of this, and consistent with the expected position for the UK implementation of the Common Reporting Standard, HMRC will remove the requirement for nil returns to reduce ongoing burdens on business. We will issue further advice regarding entities that have already registered with HMRC (whether or not they have reported yet) as soon as we can.”

UK Firms: Reduced FATCA Reporting Requirements

Update March 2015

|

FATCA Overview |

|

|

|