Telephone 020 3813 2890 for a free no obligation chat about your regulatory requirements with one of our compliance consultants.

© Compound Growth Limited 2012 - 2020 | Terms of Use Privacy Policy

Registered in England and Wales as limited company number 07626537 - Registered Office 120 Pall Mall, London, SW1Y 5EA

We use cookies, if you consent to this use, please continue to browse our site.

Here to help with Regulation and Compliance

The New Remuneration Rules 2015

Update to the UK Remuneration Rules:

24 June 2015

The UK Regulators, the FCA and the PRA, have jointly published New Remuneration Rules this week entitled ‘Strengthening the alignment of risk and reward: new remuneration rules’. These new rules include changes to both deferral and clawback of variable remuneration such as bonuses.

Their new remuneration framework seeks to bring risk and individual rewards in the banking sector in-line with each other thus discouraging irresponsible risk-taking and short-termism and encourage more effective risk management. In essence, the aim is to “embed an accountable culture in the City” as Martin Wheatley, CEO of the FCA informed.

Who do the new Remuneration Rules apply to?

The existing remuneration codes (discussed below) already cover remuneration rules that apply to all ‘material risk takers’ in various regulated firms, however the New Remuneration Rules apply to dual regulated firms such as banks, building societies and PRA-designated investment firms as well as to UK branches of non-EEA headquartered firms.

What are the Existing and New Remuneration Codes?

The regulators’ remuneration codes set out the standards and policies that certain firms are required to meet when setting pay and bonus awards for their staff and the New Remuneration code targets these for dual-regulated firms.

The New Remuneration Code:

- SYSC 19 D: Covers Remuneration within: Dual-regulated Firms within the scope of CRD IV, such as Banks, Building societies, PRA designated investment firms including Branches of non-EEA banks or building societies.

Dual-regulated firms Finalised Regulatory Guidance (New Remuneration Code)

However, the FCA already had existing remuneration rules that already apply to different types of firms. With the new remuneration code announced today, this has had some minor consequential changes to the existing remuneration codes:

Existing Remuneration Codes:

- SYSC 19A: Covers Remuneration within: FCA Regulated IFPRU deposit taker & investment firms.

These provisions have undergone minor changes as a result of the new remuneration code.

IFPRU Remuneration Code Finalised Regulatory Guidance

- SYSC 19B: Covers Remuneration within: FCA Regulated Alternative Investment Fund Managers (AIFMs) that are subject to AIFMD.

The new remuneration code has not affected these existing requirements.

AIFM Remuneration Code Finalised Regulatory Guidance

- SYSC 19C: Covers Remuneration within: FCA Regulated BIPRU Investment firms.

These provisions have undergone minor changes as a result of the new remuneration code.

BIPRU Remuneration Code Finalised Regulatory Guidance

What is the impact of the New Remuneration Code?

The periods of deferral and clawback for risk takers within firms have now been hashed out between the two regulators since issuing joint consultation papers (FCA CP 14/14 and PRA CP 15/14) last summer.

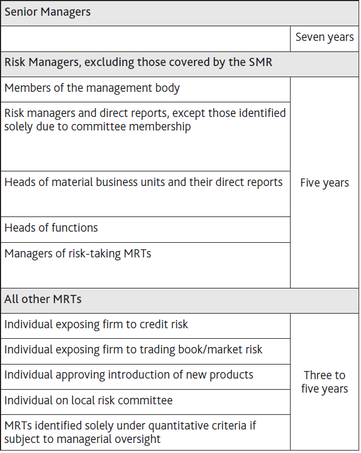

As a result there are now two tiers of defined risk takers – ‘Risk Managers’ and other Material Risk Takers ‘MTRs’ - to which differing periods will apply. Establishing this difference is to ensure that deferral and clawback periods applied to MTRs below Senior Manager, (particularly for those with relatively junior roles with limited authority to commit a firm to risk) are not disproportionately targeted.

Therefore, ‘Risk Managers’, being MRTs with more senior, managerial or supervisory roles (as established using qualitative criteria under the EBA Regulatory Technical Standard) will have a longer deferral period of five years applied to them, whilst all other MRTs will be subject to the CRD IV minimum of three to five years.

In summary, the impact of the new remuneration code means:

- Extending Deferral Periods:

o Senior Managers:

Must apply deferral periods of no less than seven years to variable remuneration awards, with no vesting before the third anniversary of award, and vesting no faster than on a pro rata basis. This is a PRA and FCA requirement.

o Risk Managers:

Must apply deferral periods of no less than five years to variable remuneration awards, with vesting no faster than pro rata from year one. This is a PRA requirement.

o All other MRTs

Must apply at least three years deferral, by applying the CRD deferral requirements of no less than three to five years to variable remuneration awards, with vesting no faster than pro rata from year one. This is a PRA and FCA requirement.

- Introducing Clawback Periods:

o Senior Managers

For Senior Managers, clawback periods will be for seven years with a possible additional three years at the end of the seven year period where a firm or regulatory authorities have commenced inquiries into potential material failures (i.e. up to 10 years clawback in total).

o All MTRs

Clawback periods will be set at seven years from the award of variable remuneration for all material risk takers. (This was already a provision imposed by the PRA, but is now additionally introduced by the FCA).

Other key points from the regulators include explicitly prohibiting variable remuneration for the senior managers of any lender that has taxpayer support (such as Lloyds or RBS) as well as for Non-Executive Directors (NEDs).

In addition, the issue of buy-outs (in which a firm compensates a new employee for any unpaid remuneration that is cancelled when they leave their previous firm) that was also addressed in last year’s consultation papers, now has the regulators looking to explore the option of requiring buy-outs to be held in a form that permits them to be subject to malus by the previous employer.

The FCA is also issuing new General Guidance on ex-post risk adjustment which is intended to share the most recent good practice as observed in the 2014 remuneration round and to clearly set out the FCA’s expectations on how relevant firms should meet the Remuneration Code requirements on ex-post risk adjustment.

When do the new remuneration requirements come into effect?

These provisions on referral and clawback periods will come into effect for performance years starting on or after 1st January 2016, with the rest of the new or amended rules (such as the new rules on Non-Executive Directors and the updated General Guidance on Ex-Post Risk adjustment) effective from 1st July 2015.

Other considerations:

With the introduction of extended clawback periods and the possibility of remuneration that has already been vested being ‘recovered’, another consideration is surely what might become of the related income tax and national insurance already paid out by individuals in the foregoing years?

Remuneration Key Terms:

- Variable Remuneration: could be bonuses or any kind of reward or discretionary pay for job performance.

- Material Risk Takers (or ‘MTRs’): those employees who, as defined by EU law, have a significant impact on the risk profile of the firm.

- Deferral: the period in which variable remuneration is withheld following the end of the accrual period.

- Clawback: the period in which staff may be required to return part or all of variable remuneration that has already been paid in certain circumstances.